SAFER AND STRONGER

MANAGING DIRECTOR AND CEO'S REPORT

The 2006/07 financial year was an excellent one for your Company. New records in safety and environmental performance, revenue of nearly nine billion dollars and a doubling of net profit made this a very profitable year in all respects.

This great result reflects the efforts of all BlueScope Steel employees and as the end of my tenure approaches, it is very pleasing to see your Company demonstrating such strong performance. So in my final report as CEO and Managing Director of BlueScope Steel, I am proud to convey the details of a strong FY2007 and the dramatic growth achieved in our first five years since listing as a public company in 2002.

Safety - Our Passion and Our Achievements

Five years ago, we promised our employees, contractors and their families that we would make BlueScope Steel an even safer place to work. Since then, we have been uncompromising in our efforts to achieve Zero Harm. During this year, we moved even closer to our goal.

In 2006/07, our Company incurred no fatal incidents, while our injury rate is at world-best standards. Lost Time Injury Frequency Rate (LTIFR) was 0.4, remaining below 1.0 for the third year running. This is a significant achievement when compared against the International Iron and Steel Institute (IISI) average of 4.0. Medically Treated Injury Frequency Rate (MTIFR) was 6.5. Today, BlueScope Steel is recognised as an industry leader and world-class employer in safety.

These results are due to a high level of dedication among our 18,000 employees, with 95 per cent regularly involved in voluntary safety audits. Many of our businesses around the world are now logging millions of hours worked without injury. Our BlueScope Steel Asia business, which covers nine countries, has not incurred a single lost time injury for 18 months with 23 million hours worked. These results are testament to the hard work and attention to safety by all of our employees and a powerful statement about the values of your Company.

Our safety journey has been an inspiring one, which I feel truly privileged to have led.

Financial performance - 2006/07 Marks a Great Year

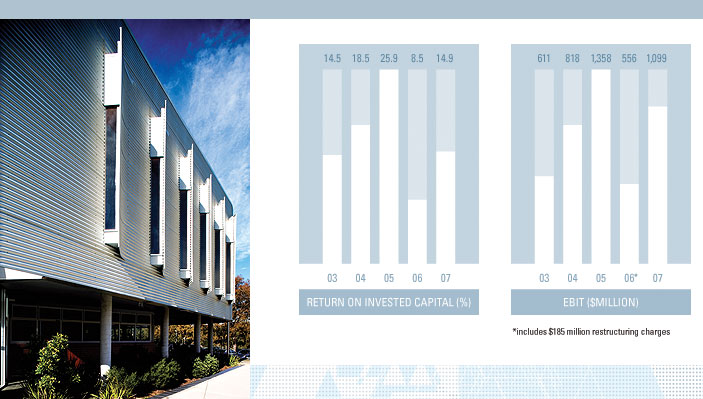

Even with the Australian dollar appreciating 5.2 per cent, revenue for the year was $8.9 billion, an increase of 11 per cent on the previous year, while EBIT rose by $543 million to $1.1 billion. Net Profit After Tax and Earnings Per Share also doubled over last year to $686 million and 95 cents respectively. Strong operating cash flow and focus on balance sheet management enabled us to reduce gearing from 38 per cent to 28 per cent which provides BlueScope Steel with a very strong financial platform for continuing growth.

These results were largely due to securing higher prices for our hot rolled coil and steel slab, improved value added exports, a favourable mix of sales into our domestic markets and stronger coated and painted coil sales volumes and pricing.

Your Company also enjoyed the full-year benefit of the Hot Strip Mill expansion at Port Kembla Steelworks, along with record steel production from this world-class operation.

Our strong operational performance led to a very strong net cash flow from operations, increasing by 67 per cent to a record $1.343 billion. Raw materials cost inflation was, again, a major impost on the Company, adding $365 million to our costs of production, primarily in the form of higher costs for iron ore, scrap, zinc, aluminium and freight.

Architects have come to appreciate the design possibilities of ZINCALUME® and COLORBOND® steels, as demonstrated in the award winning Thunder and Lightning alpine lodges at Thredbo, Australia.

Our Businesses

In 2006/07, all BlueScope Steel businesses achieved excellent operational performance. Numerous production records were set at our many facilities around the world and all BlueScope Steel reporting segments were profitable. The stronger Australian and New Zealand dollars reduced our relative global competitiveness against imports, lowering some product margins.

Our Australian and New Zealand Industrial Markets had another very good year, with Port Kembla Steelworks continuing to be the profit and cash flow engine of the Company.

In Asia, our established operations in Thailand, Indonesia and Malaysia recorded substantial volume growth with revenue and EBIT growing to record levels. New operations in China, Vietnam, and India were commissioned and ramped up. In China, industry-wide sales margins in coated products were weaker than anticipated, while the Thailand political coup delayed the expected economic expansion and reduced steel demand.

Margin compression in our metallic coating and painting businesses prevailed through most of the year. These midstream businesses confronted significant increases in zinc and steel feed costs, as well as growing exports from expanding north Asian production. They responded with solid operational performance, record production, and higher despatches.

In North America our upstream operation, joint venture North Star BlueScope Steel, delivered another outstanding year in terms of operational performance, customer service and earnings.

Downstream, our Butler Buildings business delivered another improved result driven by strong market demand in the non residential building sector, improved plant efficiencies, lower costs and a strengthening of customer relationships. The $70 million EBIT turnaround since our acquisition of the Butler business in 2004 has been a great contributor to shareholder value.

Steel Industry Change and growth

The global steel industry continues on its path of consolidation, with principal benefits being better matching of production to demand and global economies of scale and marketing. We expect this momentum to continue over the next few years.

During the year, BlueScope Steel was actively involved in the consolidation of the Australian steel industry. Recently, our Company completed the acquisition of Smorgon Steel Distribution, our largest acquisition since listing, at a net cost of $600 million. This is a great business, which brings 1,800 dedicated new employees and more than 12,000 new customers to the BlueScope Steel family. We welcome them all.

The new BlueScope Distribution business (rebranded from the recently acquired Smorgon Steel Distribution business) will provide an important channel to market, significantly expand our distribution capability for our high quality products in Australia, and further our growth strategy in downstream markets.

In June, we realised the value of our Vistawall business, which we acquired through our US$206 million purchase of Butler Manufacturing in 2004. The sale of Vistawall to Oldcastle Glass for US$190 million represents a strong financial return for shareholders and capitalises on the excellent work undertaken by BlueScope Steel's and Vistawall's management and employees in improving the business.

During the year, we closed our loss making business in Taiwan, and ceased our tinmill operations. The tinmill closure was achieved smoothly and with lower than expected costs, thanks to the excellent performance of the tinmill employees.

In May, we announced a US$101 million investment in our Indonesia operation to complete the construction of a second metallic coating line with in-line painting capability. This new facility will produce thin gauge coil to meet the strong residential demand.

Our $150 million Western Sydney COLORBOND® steel facility commenced operations in August 2007 and BlueScope Water continues to experience strong growth with an expanding order book for our commercial and urban water products.

Five year anniversary

This is our fifth year since demerger and public listing and we can now truly say the transformation of BlueScope Steel from the former BHP Steel is complete.

From the beginning, our focus has been on creating value for shareholders while we grow. In building this 'very different kind of steel company' we have never strayed from the principle of shareholder rewards. BlueScope Steel's Enterprise Value has now more than tripled to approximately $9 billion. The initial share price in 2002 has been fully returned to owners via $2.3 billion in dividends and share buybacks.

Our growth strategy has been successful in diversifying the Company's revenue, products, and markets. Consequently, revenue and EBITDA have each doubled over the past five years. BlueScope Steel has grown from 11,000 to 18,000 employees and approximately 90 per cent of our employees are also shareholders.

In 2002, we were known as an Australian steel maker. Today, our Company is also a leading global provider of steel building products and solutions. We have become a globally diverse company with 91 manufacturing plants in 17 countries around the world. BlueScope Steel has invested in its future and over five years, 20 major capital projects in 8 countries have been implemented with operations now ramping up for our next exciting growth phase.

Environment

In 2006/07 we demonstrated our commitment to the environment with the announcement of two major water saving initiatives. The first was a major recycling program between BlueScope Steel and Sydney Water. This has halved the use of fresh water at Port Kembla, equivalent to the annual water use of 26,000 households. The second initiative, a $21 million landmark project with South East Water and the Victorian Government, will cut fresh water use at our Western Port plant by over 60 per cent or 660 million litres annually. This is equivalent to water consumption of about 3,000 homes.

Your Company is committed to reducing greenhouse gas emissions. We recognise global warming as a serious community concern and a global issue that requires a global response.

We are currently examining the feasibility of a new co-generation plant at Port Kembla Steelworks. This plant will use by-product gases to produce steam for our internal use. It will also generate electricity, to be fed into the NSW grid. The result would be a net reduction of 800,000 tonnes of greenhouse gases a year - the equivalent of taking 185,000 cars off the road. We expect to have a clear view on how to proceed with this project by June 2008.

Right: XLERPLATE® steel is the material of choice in the growing number of wind farms used to generate 'green' electricity, as shown here at Mt Gambier, South Australia.

People

The Company recently announced Paul O'Malley as the next Managing Director and CEO of BlueScope Steel. I believe Paul will be a strong successor and am particularly pleased the Board has chosen your new CEO from within the ranks of our very strong executive leadership team.

Outlook

This year, the global steel market was very strong with the forecast for steel demand worldwide remaining positive. China, the USA and Europe are driving this healthy outlook. The Asia region now produces more than half of worldwide demand growth.

While the Chinese government has been working to close and eliminate inefficient mills and reduce exports through its recent export tax, these initiatives have not significantly slowed production growth nor reduced the global effect of exports. In Australia, we started FY2008 with a stronger local currency, stable global steel price environment and high metal coating costs. In North America, the commercial industrial construction market remains strong for our Butler business which has no residential exposure, but the spread between HRC prices and scrap cost has narrowed for our North Star BlueScope Steel joint venture business. Asian markets and opportunities are slightly improved and the operational ramp-up of new sites is growing revenue while coated product margins continue to be under pressure, particularly in China.

We will continue to aggressively manage those factors we can control, including safety and environment, containing costs, improving our processes, achieving volume and production efficiencies, and optimising mix and margins. Clearly, the benefit of a global footprint and the diversity of our product lines will be advantageous going forward.

After five years of growth and with another very strong year concluded, we thank our shareholders and customers for their continuing support. I would like to personally thank our employees for their commitment and dedication. They have made BlueScope Steel an outstanding company, of which we are all very proud.

Finally, I thank shareholders for the opportunity to lead, build, and transform the iconic BlueScope Steel which is now strongly positioned for its next phase of growth.

KIRBY ADAMS, MANAGING DIRECTOR AND CEO

Below: The Illawarra Institute's Library and Information Services building at Shellharbour TAFE campus NSW, Australia, capitalises on the superior environmental qualities of steel to achieve a 40 per cent reduction in energy use.